Charts of the Week - Unempoyment Claims; Inflation Measurements

The discussion about the sustainability of the US labor market has faded somewhat. Some time ago they could not stop talking about the jobless recovery and all the dangerous things implied by that. Now the focus changed to other issues: commodity prices and inflation, for example. In some ways this is reassuring observation: the market is looking again and again for sources of concern. As long as something appears to be on the right track, they loose interest...

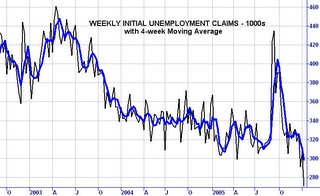

But how does it look like on the "labor front" in the "meantime":

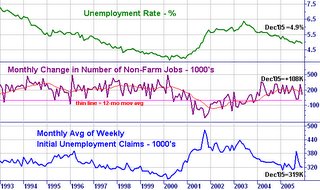

And the more complete picture:

The labor market sees (present time!) gradual improvements. All in all it is may be not that rapid, though the development is robust. There are new jobs, the unemployment rate decreases, and it will surely provide support to the further economic growth and consumption.

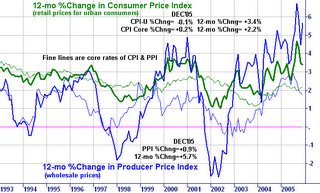

And how about the inflation?

The fearing is not over yet. Yes, I am not overly concerned about inflation peak and even less about uncontrolled development. The forces of technology, globalization and competition combined with the solid grip of the Fed will prevent it. However, the picture does not show yet much of easing. Or may be though: if that tendency in the core PPI is sustainable...

But I ask myself - what do the bond investors do with interst rates almost below the inflation rate? This irrationality - in my humble opinion - will either be paid with losses (raising interest rates in the long end) or they are though right, and the inflation comes down (probably together with the economy).

The first will may be provide a more difficult environment for the stock markets. There is a chance to see a rush out of bonds and - at least partly - into stocks. But a raising interst will then surely mean some throuble for the shares.

The second way is the smoother one, because I do not expect big problems with the stock markets even if the economy cools off. The valuation (and the valuation basis then - the interest rates) are and will (hopefully) still be favorable.

So, economy and labor go nice, and consumprion may be more robust than expected. The inflation is still a concern and will decide on the way how we move the way up - more calmly or more volatile. In my humble opinion.

PS (to whom it may concern): I appreciate exchange of thoughts and information between the blogs, though please link properly to Bourse Diary and do not use complete postings without permission and reference.

stocks bourse inflation empoyment

0 Comments:

Post a Comment

<< Home